Certificate of Origin: A Simple and Easy Guide [+Template]

October 28, 2022 Documentation

![Certificate of Origin: A Simple and Easy Guide [+Template] Certificate of Origin: A Simple and Easy Guide [+Template]](https://icecargo.com.au/wp-content/uploads/2022/10/Certificate-of-Origin-Guide.jpg)

When importing or exporting around the world, a Certificate of Origin can be of substantial benefit. If the country of import or export has a free trade agreement (FTA) with Australia, duty charges may be avoided.

In this blog, you will find out:

- What is the Certificate Of Origin

- Why is it particularly important to Australian importers and exporters to have one

- How you can obtain this declaration

So read on and download our step-by-step template.

What is a Certificate of Origin (COO)?

A Certificate of Origin is a declaration that details the country in which your goods are made. The document, whilst identifying goods, contains a confirmation from a government authority that the goods being shipped are manufactured in a specific country.

A COO applies to a single shipment. It may cover one or more goods, but must not exceed 20 items (that is, 20 unique goods) and may be valid for up to one year.

When Is A Certificate Of Origin Required?

For international trading, when you need to export goods from Australia (irrespective of whether they are produced/manufactured/processed in Australia or any other country), you need a certificate of origin. It can help determine whether certain goods are eligible for import, whether goods are subject to duties or tariff reductions, which we will further discuss below.

A Certificate of Australian Origin is often required:

- To export certain goods from Australia

- For customs clearance at the port of delivery

- Occasionally by the overseas buyer or the business receiving your goods

- As stipulated in a letter of credit. In some instances, the company receiving the goods will require a Certificate of Origin before authorising their bank to issue a letter of credit and thus payment.

How To Obtain a Certificate Of Origin?

The Certificate of Origin is always issued by the government authority where the goods are originally from. The government authority or body empowered to issue this Certificate of Origin is usually a Chamber of Commerce, which is an organisation set up to promote, protect and represent the interests of the various businesses in the community or area in which they are present.

The easiest and most recommended way to obtain the document though is by contacting your supplier or your freight forwarding agent.

Below are the steps detailing how a COO is issued.

Step 1 – Find an Authorised Issuer

In Australia, there are a total of 11 authorized Certificate Of Origin issuers, as per the list below. Members of these chambers can take advantage of significant concessions in the COO processing fees.

- AACCI Australia Arab Chamber of Commerce & Industry

- ACT: ACT & Region Chamber of Commerce & Industry

- Ai Group: issue certificates nationally

- Canberra Business Chamber issues Certificates of Origin

- NSW: NSW Business Chamber

- NT: Chamber NT

- QLD: Chamber of Commerce & Industry Queensland

- SA: Business SA

- TAS: Tasmanian Chamber of Commerce and Industry

- VIC: Victorian Chamber of Commerce

- WA: Chamber of Commerce & Industry Western Australia

For exporters to China, Australia’s authorised bodies are:

- The Australian Chamber of Commerce and Industry (ACCI);

- The Australian Industry Group (AIG); and,

- The Australian Grape and Wine Authority (AGWA) (for wine and wine-related products).

For importers to Australia, China’s authorised bodies are:

- The General Administration of Customs of China

- The China Council for the Promotion of International Trade

While Chambers are the key agents of delivery of these international trade documents, other bodies, such as ministries or customs authorities may also have this privilege in certain countries.

Many chambers of commerce offer online COO services to expedite the application and issuance process, as well as security. The electronic COO comes with safeguard measures, such as online verification of the authenticity of the Certificate of Origin.

Step 2 – Complete The Form

The process for obtaining the document requires the exporter to complete the Exporter Registration Form (usually called the CO4 Form). The form provides important details about the exporter, the business and company. It must be filled only once and you can use the details to get COO processed any number of times in the future. Lastly, the form must include the list of authorized signatories who can act on behalf of your business or company.

Step 3 – Provide Evidence Of Your Transactions

The Chamber of Commerce requires the exporters to provide evidences for the export transaction. These evidences include the invoice copies, letter of credit, bill of lading and so on. Take notice of the right formats required in order to avoid delays in your processing.

Other Proofs Of Origin

Customs department in the importing country may require a proof of origin in order to determine whether or not the cargo that is imported may be subjected to trade measures such as the preferential duty tariff, free trade deals, prohibited goods, etc.

As per the World Customs Organisation definition, a “proof of origin” is a document or statement (either in paper or electronic format) which serves as evidence of the origin of the goods. A proof of origin may be

1. a “certificate of origin” which means a specific form, whether on paper or electronic, in which the government authority or body empowered to issue it expressly certifies that the goods to which the certificate relates are considered originating according to the applicable rules of origin;

2. a “self-issued certificate of origin” which means a specific form in which the producer, manufacturer, exporter or importer expressly certifies that the goods to which the certificate relates are considered originating according to the applicable rules of origin;

3. a “declaration of origin” which means a statement as to the originating status of goods made by the producer, manufacturer, exporter or importer on the commercial invoice or any other document relating to the goods;

Certified export documentation is required by many countries. Understanding the right export documents is essential for smooth import and export procedures, to ensure customs clearance and facilitate duty exemptions.

Certificate Of Origin Downloadable Template

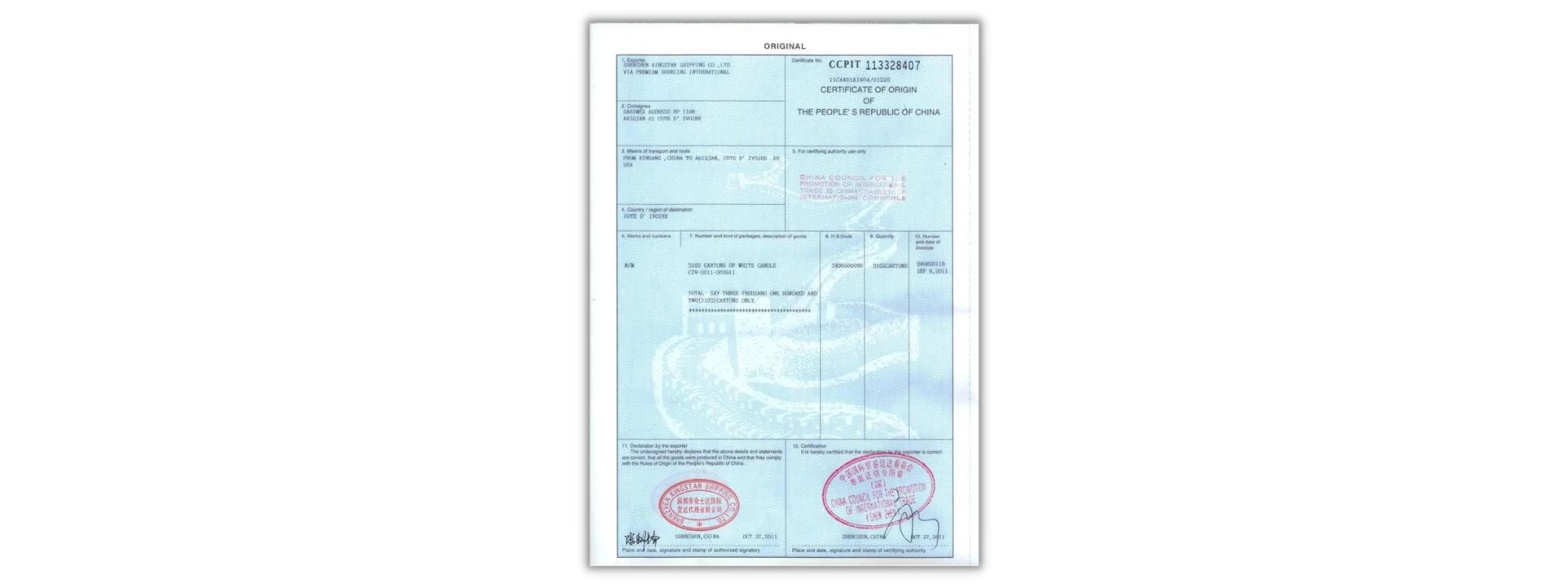

There is no standardised Certificate of Origin form for global trade, but a COO, normally prepared by the exporter of goods and notarized by a chamber of commerce, has at least the basic details about the product being shipped such as a tariff code, the exporter and importer details and the country of origin.

Check our sample below with clear guidance to complete a certificate of origin.

Free Trade Agreements (FTAs)

Free Trade Agreements are treaties between two or more countries that reduce and can even eliminate certain barriers to international trade and investment. These agreements are entered into in a bid to benefit Australian importers, exporters, producers and investors. You can read more about the FTAs Australia has in place here.

So, who does Australia have FTAs with?

Australia has a number of FTAs in place. The links below provide examples of certificates of origin to support these FTAs.

• New Zealand (ANZCERTA)

• Singapore (SAFTA)

• USA (AUSFTA)

• Thailand (TAFTA)

• Chile (ACIFTA)

• ASEAN countries (AANZFTA)

• Malaysia (MAFTA)

• Korea (KAFTA)

• Japan (JAEPA)

• China (CHAFTA)

• Canada (CANATA)

There are a number of FTAs currently being negotiated. Most recently, the European Commission signalled an intent to commence such negotiations.

FTA Benefits – Tariff Reductions and Duty-Free

Origin of the imported goods has a strong effect on import customs duties, as almost every country in the world considers the origin of goods when determining applicable import duties.

Free Trade Agreements aim to lower trade barriers, the most common being reductions of tariffs and duties on imported goods. Firms can expect reduced or duty-free passage of cargo and efficient clearance of goods.

For example, Australian exports must be registered under the Thailand-Australia Free Trade Agreement (TAFTA) and accompanied by a TAFTA Certificate of Origin in order to qualify for the preferential rates.

Wish you knew this sooner? Good News! If you have paid duty when importing from a country that has an FTA with Australia, you may be able to claim rebates on these duties using a Certificate of Origin. Simply contact our customs brokers on 1300 CARGO1 and we will be on hand to assist.

Keep in mind

If you are preparing to import or export, consider whether a Certificate of Origin may make the process more cost-effective. It is always a good idea to have your customs consultant review all relevant shipping documentation prior to any cargo departure. They can provide invaluable advice and ensure you don’t get caught out with hidden charges or paperwork issues.

Should you have any questions regarding Certificates of Origin please contact your ICE team member.

or call us on 1300 227 461

When importing or exporting around the world, a Certificate of Origin can be of substantial benefit. If the country of import or export has a free trade agreement (FTA) with Australia, duty charges may be avoided.

In this blog, you will find out:

- What is the Certificate Of Origin

- Why is it particularly important to Australian importers and exporters to have one

- How you can obtain this declaration

So read on and download our step-by-step template.

What is a Certificate of Origin (COO)?

A Certificate of Origin is a declaration that details the country in which your goods are made. The document, whilst identifying goods, contains a confirmation from a government authority that the goods being shipped are manufactured in a specific country.

A COO applies to a single shipment. It may cover one or more goods, but must not exceed 20 items (that is, 20 unique goods) and may be valid for up to one year.

For international trading, when you need to export goods from Australia (irrespective of whether they are produced/manufactured/processed in Australia or any other country), you need a certificate of origin. It can help determine whether certain goods are eligible for import, whether goods are subject to duties or tariff reductions, which we will further discuss below.

A Certificate of Australian Origin is often required:

- To export certain goods from Australia

- For customs clearance at the port of delivery

- Occasionally by the overseas buyer or the business receiving your goods

- As stipulated in a letter of credit. In some instances, the company receiving the goods will require a Certificate of Origin before authorising their bank to issue a letter of credit and thus payment.

How To Obtain a Certificate Of Origin?

The Certificate of Origin is always issued by the government authority where the goods are originally from. The government authority or body empowered to issue this Certificate of Origin is usually a Chamber of Commerce, which is an organisation set up to promote, protect and represent the interests of the various businesses in the community or area in which they are present.

The easiest and most recommended way to obtain the document though is by contacting your supplier or your freight forwarding agent.

Below are the steps detailing how a COO is issued.

Step 1 – Find an Authorised Issuer

In Australia, there are a total of 11 authorized Certificate Of Origin issuers, as per the list below. Members of these chambers can take advantage of significant concessions in the COO processing fees.

- AACCI Australia Arab Chamber of Commerce & Industry

- ACT: ACT & Region Chamber of Commerce & Industry

- Ai Group: issue certificates nationally

- Canberra Business Chamber issues Certificates of Origin

- NSW: NSW Business Chamber

- NT: Chamber NT

- QLD: Chamber of Commerce & Industry Queensland

- SA: Business SA

- TAS: Tasmanian Chamber of Commerce and Industry

- VIC: Victorian Chamber of Commerce

- WA: Chamber of Commerce & Industry Western Australia

For exporters to China, Australia’s authorised bodies are:

- The Australian Chamber of Commerce and Industry (ACCI);

- The Australian Industry Group (AIG); and,

- The Australian Grape and Wine Authority (AGWA) (for wine and wine-related products).

For importers to Australia, China’s authorised bodies are:

- The General Administration of Customs of China

- The China Council for the Promotion of International Trade

While Chambers are the key agents of delivery of these international trade documents, other bodies, such as ministries or customs authorities may also have this privilege in certain countries.

Many chambers of commerce offer online COO services to expedite the application and issuance process, as well as security. The electronic COO comes with safeguard measures, such as online verification of the authenticity of the Certificate of Origin.

Step 2 – Complete The Form

The process for obtaining the document requires the exporter to complete the Exporter Registration Form (usually called the CO4 Form). The form provides important details about the exporter, the business and company. It must be filled only once and you can use the details to get COO processed any number of times in the future. Lastly, the form must include the list of authorized signatories who can act on behalf of your business or company.

Step 3 – Provide Evidence Of Your Transactions

The Chamber of Commerce requires the exporters to provide evidences for the export transaction. These evidences include the invoice copies, letter of credit, bill of lading and so on. Take notice of the right formats required in order to avoid delays in your processing.

![Certificate of Origin: A Simple and Easy Guide [+Template] Certificate of Origin: A Simple and Easy Guide [+Template]](https://icecargo.com.au/wp-content/uploads/2022/10/document-in-envelope.png)

Other Proofs Of Origin

Customs department in the importing country may require a proof of origin in order to determine whether or not the cargo that is imported may be subjected to trade measures such as the preferential duty tariff, free trade deals, prohibited goods, etc.

As per the World Customs Organisation definition, a “proof of origin” is a document or statement (either in paper or electronic format) which serves as evidence of the origin of the goods. A proof of origin may be

1. a “certificate of origin” which means a specific form, whether on paper or electronic, in which the government authority or body empowered to issue it expressly certifies that the goods to which the certificate relates are considered originating according to the applicable rules of origin;

2. a “self-issued certificate of origin” which means a specific form in which the producer, manufacturer, exporter or importer expressly certifies that the goods to which the certificate relates are considered originating according to the applicable rules of origin;

3. a “declaration of origin” which means a statement as to the originating status of goods made by the producer, manufacturer, exporter or importer on the commercial invoice or any other document relating to the goods;

Certified export documentation is required by many countries. Understanding the right export documents is essential for smooth import and export procedures, to ensure customs clearance and facilitate duty exemptions.

Certificate Of Origin Downloadable Template

There is no standardised Certificate of Origin form for global trade, but a COO, normally prepared by the exporter of goods and notarized by a chamber of commerce, has at least the basic details about the product being shipped such as a tariff code, the exporter and importer details and the country of origin.

Check our sample below with clear guidance to complete a certificate of origin.

![Certificate of Origin: A Simple and Easy Guide [+Template] Certificate of Origin: A Simple and Easy Guide [+Template]](https://icecargo.com.au/wp-content/uploads/2022/10/certificate-of-origin-template.jpg)

Free Trade Agreements (FTAs)

Free Trade Agreements are treaties between two or more countries that reduce and can even eliminate certain barriers to international trade and investment. These agreements are entered into in a bid to benefit Australian importers, exporters, producers and investors. You can read more about the FTAs Australia has in place here.

So, who does Australia have FTAs with?

Australia has a number of FTAs in place. The links below provide examples of certificates of origin to support these FTAs.

• New Zealand (ANZCERTA)

• Singapore (SAFTA)

• USA (AUSFTA)

• Thailand (TAFTA)

• Chile (ACIFTA)

• ASEAN countries (AANZFTA)

• Malaysia (MAFTA)

• Korea (KAFTA)

• Japan (JAEPA)

• China (CHAFTA)

• Canada (CANATA)

There are a number of FTAs currently being negotiated. Most recently, the European Commission signalled an intent to commence such negotiations.

FTA Benefits – Tariff Reductions and Duty-Free

Origin of the imported goods has a strong effect on import customs duties, as almost every country in the world considers the origin of goods when determining applicable import duties.

Free Trade Agreements aim to lower trade barriers, the most common being reductions of tariffs and duties on imported goods. Firms can expect reduced or duty-free passage of cargo and efficient clearance of goods.

For example, Australian exports must be registered under the Thailand-Australia Free Trade Agreement (TAFTA) and accompanied by a TAFTA Certificate of Origin in order to qualify for the preferential rates.

Wish you knew this sooner? Good News! If you have paid duty when importing from a country that has an FTA with Australia, you may be able to claim rebates on these duties using a Certificate of Origin. Simply contact our customs brokers on 1300 CARGO1 and we will be on hand to assist.

Keep in mind

If you are preparing to import or export, consider whether a Certificate of Origin may make the process more cost-effective. It is always a good idea to have your customs consultant review all relevant shipping documentation prior to any cargo departure. They can provide invaluable advice and ensure you don’t get caught out with hidden charges or paperwork issues.

Should you have any questions regarding Certificates of Origin please contact your ICE team member.

or call us on 1300 227 461

We Consult. We Plan. We Deliver.

- CONSULT – We discuss your specific needs.

- PLAN – We develop a bespoke tailored plan that is cost-effective & efficient.

- DELIVER – We manage your shipment and keep you updated from beginning to end.